Open the Advantages of a Federal Cooperative Credit Union Today

Explore the untapped benefits of straightening with a federal credit scores union, a critical economic relocation that can change your banking experience. From special participant advantages to a solid area values, federal lending institution use an unique approach to monetary services that is both customer-centric and financially advantageous. Discover just how this alternative banking model can provide you with a special viewpoint on economic wellness and long-term stability.

Benefits of Signing Up With a Federal Cooperative Credit Union

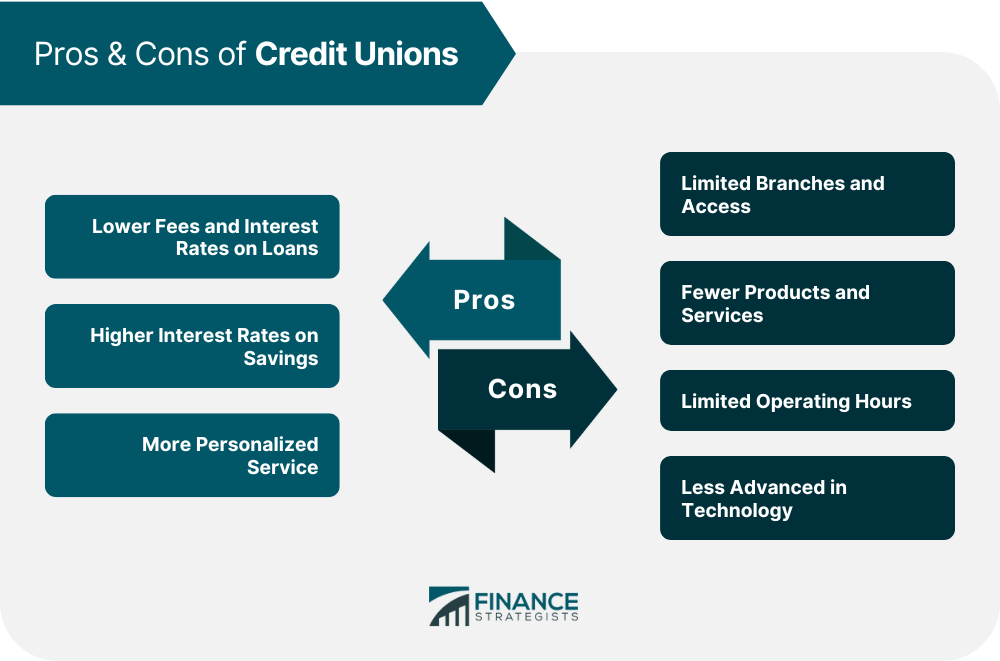

One of the key benefits of signing up with a Federal Credit Union is the emphasis on participant satisfaction rather than producing earnings for investors. Furthermore, Federal Credit history Unions are not-for-profit companies, allowing them to supply competitive passion prices on savings accounts, lendings, and credit rating cards (Credit Unions Cheyenne WY).

An additional advantage of joining a Federal Credit rating Union is the sense of neighborhood and belonging that members frequently experience. Federal Debt Unions typically supply financial education and sources to help members boost their economic literacy and make notified decisions regarding their cash.

Lower Charges and Competitive Rates

Furthermore, federal lending institution are known for supplying competitive passion prices on interest-bearing accounts, loans, and bank card (Credit Unions Cheyenne WY). This means that participants can make extra on their financial savings and pay much less interest on loans contrasted to what typical banks might supply. By providing these affordable rates, government cooperative credit union prioritize the monetary well-being of their participants and strive to aid them accomplish their financial goals. In general, the lower fees and affordable prices provided by federal credit report unions make them a compelling selection for people looking to maximize their financial benefits.

Individualized Customer Support

A trademark of government lending institution is their dedication to giving individualized client service customized to the individual needs and choices of their members. Unlike typical financial institutions, government credit unions prioritize developing strong partnerships with their participants, intending to offer a much more individualized experience. This tailored strategy suggests that participants are not simply viewed as an account number, but rather as valued individuals with special economic goals and situations.

One means federal debt unions supply personalized customer support is through their member-focused technique. Reps put in the time to understand each member's certain monetary circumstance and deal personalized remedies to satisfy their demands. Whether a member is aiming to open up a brand-new account, obtain a funding, or look for economic guidance, federal credit report unions strive to supply tailored guidance and support every step of the method.

Community-Focused Campaigns

To even more improve their effect and connection with participants, federal lending institution actively take part in community-focused efforts that add to the well-being and advancement of the locations they offer. These initiatives usually consist of economic education programs targeted at encouraging people with the knowledge and skills to make informed choices about their financial resources (Credit Unions Cheyenne WY). By providing workshops, workshops, and individually therapy sessions, cooperative credit union assist neighborhood participants boost their financial literacy, handle financial debt successfully, and strategy for a check protected future

In addition, government cooperative credit union often get involved in local events, sponsor area projects, and support charitable reasons to Full Article address particular needs within their solution locations. This participation not just demonstrates their dedication to social duty however additionally reinforces their relationships with participants and fosters a sense of belonging within the neighborhood.

Through these community-focused initiatives, federal credit score unions play an essential role in promoting financial incorporation, financial security, and total prosperity in the regions they operate, inevitably producing a positive impact that extends past their typical financial services.

Optimizing Your Membership Benefits

When aiming to make the most of your membership advantages at a credit rating union, recognizing the variety of resources and solutions readily available can significantly enhance your economic wellness. Federal cooperative credit union offer a variety of advantages to their participants, including affordable interest prices on interest-bearing accounts and fundings, reduced charges compared to standard financial institutions, and customized customer care. By maximizing these advantages, participants can boost their monetary security and accomplish their objectives much more effectively.

In addition, participating in financial education and learning programs and workshops supplied by the credit rating union can assist you improve your cash monitoring abilities and make more enlightened choices regarding your monetary future. By actively engaging with the resources readily available to you as a participant, you can open the complete capacity of your relationship with the credit scores union.

Conclusion

Finally, the benefits of signing up with a federal credit report union consist of lower costs, affordable prices, customized client service, and community-focused campaigns. By maximizing your subscription benefits, you can access price financial savings, tailored solutions, and a sense of belonging. Take into consideration unlocking the advantages of a federal cooperative credit union today to experience a banks that focuses on member complete satisfaction and uses a variety of resources for economic education.

Additionally, Federal Credit scores Unions are not-for-profit companies, permitting them to use competitive passion prices on financial savings accounts, financings, and credit history cards.

Federal Credit Unions often supply economic education and learning and resources to assist participants enhance their financial literacy and make notified decisions regarding my sources their cash.